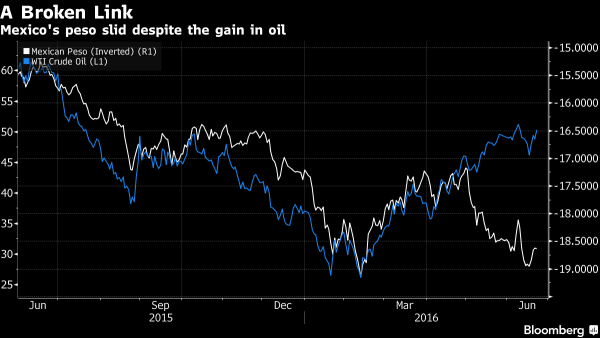

The link between oil and the Mexican peso is weakening. This has firms like BNP Paribas SA warning the nation’s bond market could suffer, bloomberg.com reports.

While Mexico’s fortunes have long been tied to the price of oil, that relationship has eroded as some investors sell the currency to hedge against global risks, including Britain’s possible exit from the European Union, said Banorte Ixe. So even as crude has climbed 7 percent since the end of April, the peso has plummeted 8 percent.

The slumping peso prompted BNP Paribas SA to say June 17 that there’s “considerable” risk that overseas holders of longer-term government bonds called Mbonos may begin to dump the securities. They’ve already chopped their holdings of short-term debt to the lowest since 2009 and an exodus from Mbonos would be a problem for Mexico because foreigners own 42 percent of them.

“People are throwing in the towel,” said Alvaro Vivanco, the head of local markets strategy at Banco Bilbao Vizcaya Argentaria SA. “A lot of real-money foreign investors are becoming frustrated with Mbonos because of the performance of the peso.”

Source: bloomberg.com