324

Cupertino, California — Apple announced on Wednesday March 27th, an innovative new kind of credit card created by Apple and designed to help customers lead a healthier financial life. Apple Card is built into the Apple Wallet app on iPhone, offering customers a familiar experience with Apple Pay and the ability to manage their card right on their iPhones.

Apple Card transforms the entire credit card experience by simplifying the application process, eliminating fees, encouraging customers to pay less interest and providing a new level of privacy and security.

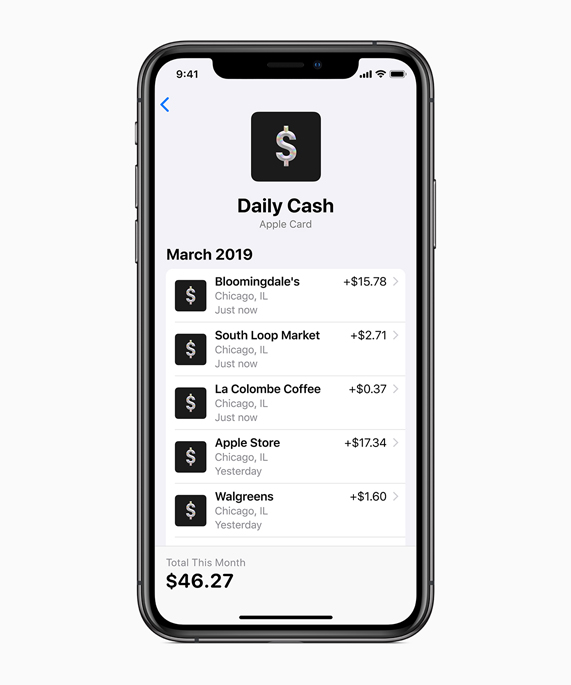

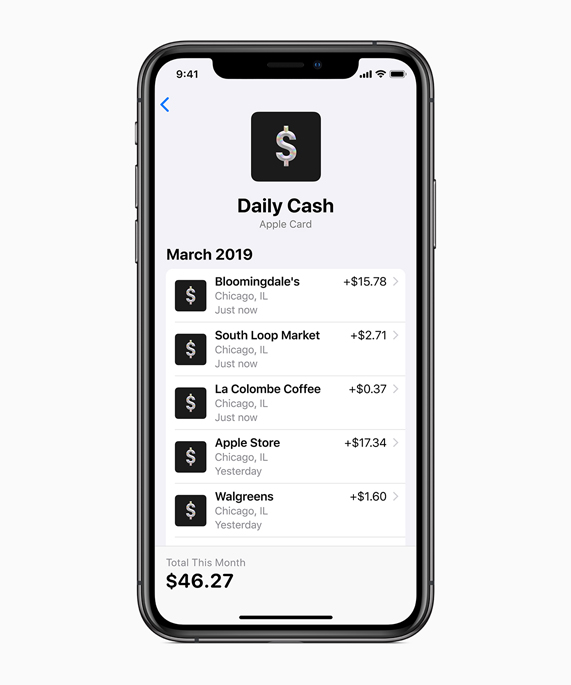

Available in the U.S. this summer, Apple Card will also offer a clearer and more compelling rewards program than any other credit card in the market, with “Daily Cash”, which gives back a percentage of every purchase as cash on customers’ Apple Cash card each day.

“Apple Card builds on the tremendous success of Apple Pay and delivers new experiences only possible with the power of iPhone,” said Jennifer Bailey, vice president of Apple Pay.

“Apple Card is designed to help customers lead a healthier financial life, which starts with a better understanding of their expenditure so they can make smarter choices with their money, and have a better understanding of their financial life,” Bailey added.

Goldman Sachs and Mastercard

Apple is partnering up with Goldman Sachs and Mastercard to provide the support of an issuing bank and global payments network. As a newcomer to consumer financial services, Goldman Sachs is creating a different credit card experience centered around the customer, which includes never sharing or selling data to third parties for marketing and advertising. Mastercard will provide cardholders the ability to shop at merchants around the globe.

Take a look for yourself here

TYT Newsroom