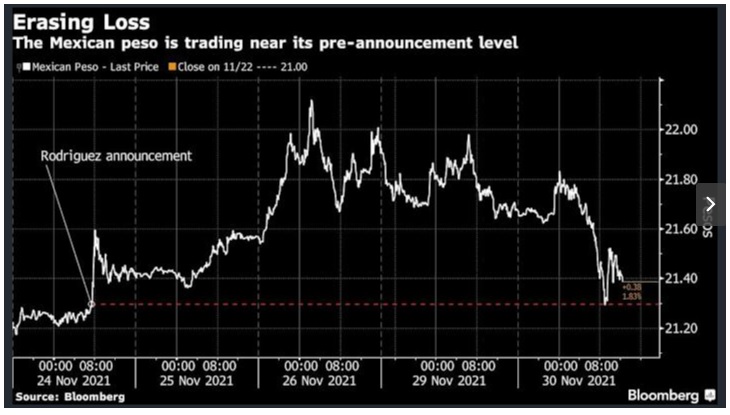

(Bloomberg) — The Mexican peso rebounded against the dollar, recovering from three-day slump driven by a surprise announcement for the future leadership of the Mexican central bank.

The peso climbed as much as 1.8% on the day to 21.2839 on Tuesday, briefly strengthening back to where it was before the announcement that Victoria Rodriguez would be nominated to head Banco de Mexico.

The nomination has stirred a great deal of uncertainty in Mexican markets as traders assess Rodriguez’s qualifications. The candidate has little experience with central banking and has close ties to President Andres Manuel Lopez Obrador, prompting fears that the institution won’t be as steadfastly independent as it has been in the past.

That focus on a new central bank chief ebbed Tuesday, with the peso the best emerging currency after the Chilean peso, benefiting from a broadly weaker dollar. The greenback took center stage as traders assessed prospects for the Federal Reserve tightening monetary policy amid concerns over a new omicron variant. The U.S. currency pared declines as traders boosted bets on the pace of tightening after comments by Chair Jerome Powell on the prospect for faster tapering.

Source: El Financiero

TYT Newsroom