Trucks are ubiquitous on American roadways.

However, they’ve become increasingly important in trade with its neighbors, Mexico and Canada, as relations with China cool and the United States government encourages “nearshoring,” the practice of moving part of a company’s production to nearby countries with similar time zones. In 2022, there were about 5.5 million truck crossings at the U.S.-Canada border and 7.25 million at the U.S.-Mexico border.

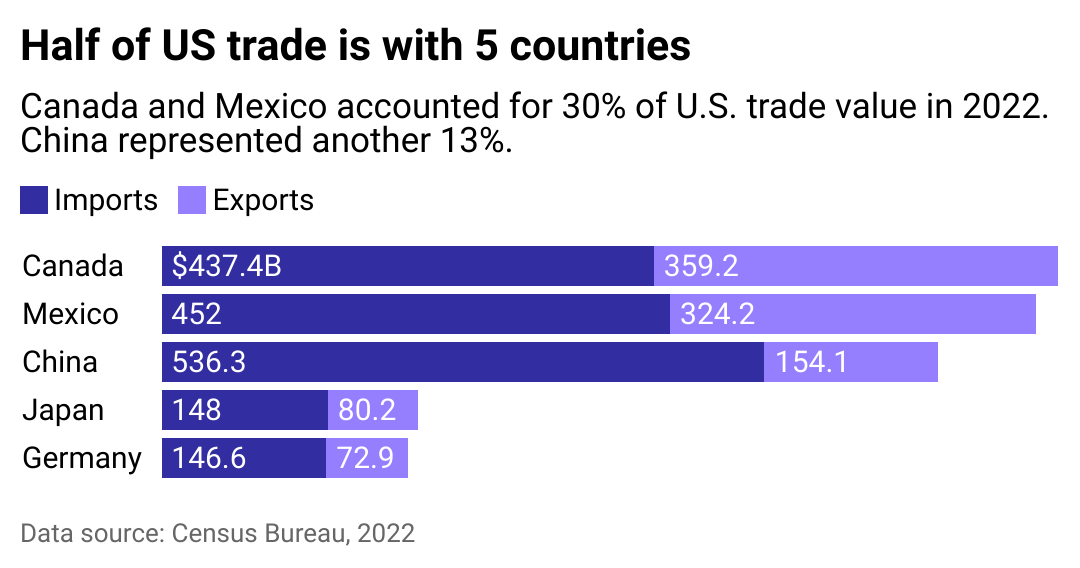

Trade with Canada and Mexico (much of it via land instead of water or rail) has recently outpaced trade with China, which has long dominated the international trade landscape.

Truck Parking Club used data from the Bureau of Transportation Statistics and Census Bureau to explore U.S. freight trade with Canada and Mexico.

Geopolitical pressures shift top trading partners

For the first time in decades, Mexico overtook China in the number of goods bought and sold to the U.S. in 2023. Centers for Disease Control and Prevention data shows that Canada claimed first place, taking the title of top trade partner.

The shift follows the push to embrace nearshoring. The United States’ dependence on the fragile worldwide supply chain came into focus during the coronavirus pandemic. Then, shipments of vital supplies like computer chips, personal protection equipment, and medication faced shipping backlogs and caused shortages worldwide. Nearshoring policies aimed to encourage suppliers to keep materials and the manufacturing processes geographically closer to the U.S.—not only to have them readily available in case of an emergency but to encourage the economic growth of the U.S. and its direct neighbors.

The trade war between the U.S. and China that began in 2018 and the subsequent Russian invasion of Ukraine worried U.S. investors. They recognized the war would bring more sanctions and devolve international business relations and figured it was better to transition some manufacturing to North American soil and U.S. allies.

Increased tariffs on Chinese goods imposed by the Trump administration and carried through the Biden administration also made an impact, forcing companies to look for suppliers and manufacturers closer to the United States. The international North American Free Trade Agreement and its successor, the United States-Mexico-Canada Agreement, imposed strict rules outlining what percentage of an item must be produced in North America. For example, under the USMCA, 70% of a vehicle manufacturer’s steel and aluminum purchases by value must originate in North America, and those companies that don’t meet the mark may face additional tariffs.

The outsized role of trucks in US trade

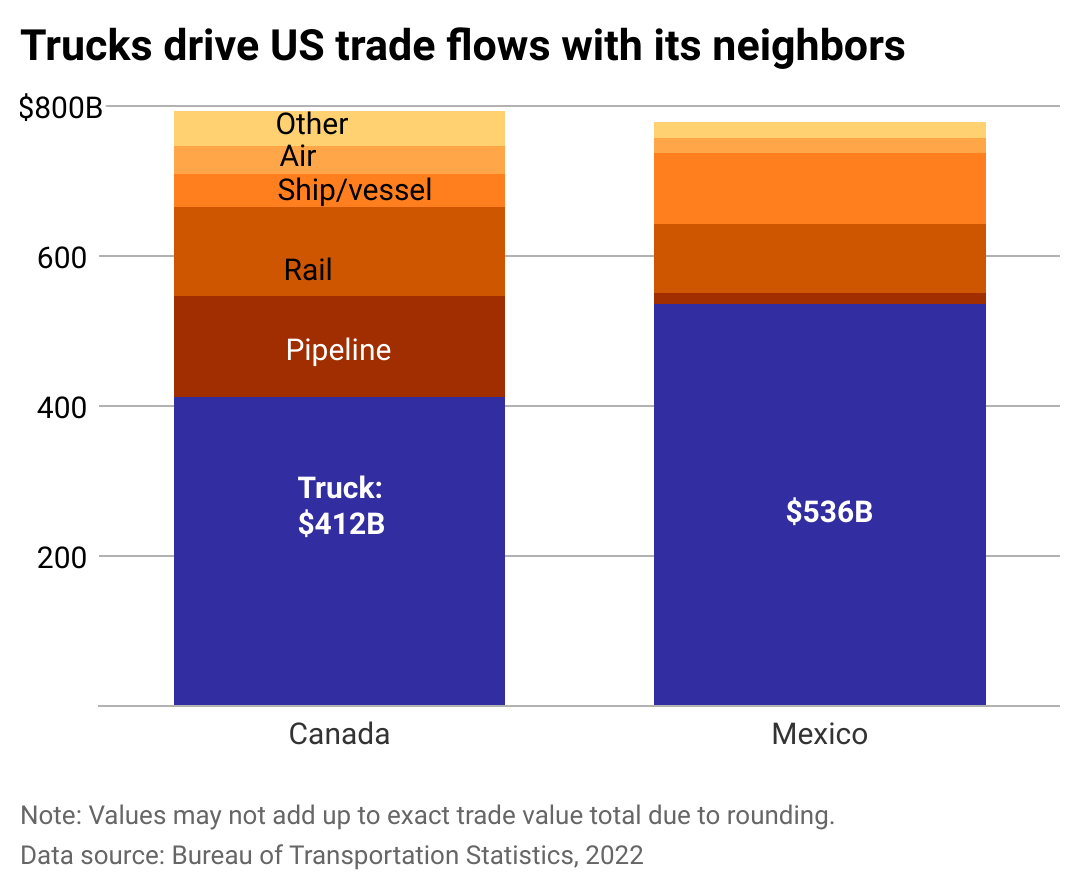

Most trade among the U.S. and its neighbors occurs through trucking, and the percentage of goods arriving on trucks continues to increase. According to the BTS, $948.0 billion in goods were shipped via truck from and to Canada and Mexico, while goods shipped via trains accounted for $210.2 billion in 2022. The value of truck freight increased by 14.5%, while rail increased by 12.7% between 2021 and 2022.

The U.S., Canada, and Mexico are each other’s largest trade partners for oil, energy, automobiles, electronics, and agricultural goods—and it’s common for materials to be procured from one country, produced into goods in a second, and then marketed and sold in a third.

According to the BTS, U.S. trade with Canada and Mexico accounted for almost a quarter of the country’s international trade. There is hope these ties will economically lift the whole continent and establish stronger labor policies. The USMCA fast-tracks labor dispute processes and requires manufacturers to allow their employees to unionize, leading to higher wages. It pushes Mexico, in particular, to enforce existing employee rights, according to a Brookings Institution analysis.

CLICK HERE TO READ THE FULL ARTICLE ON AOL

TYT Newsroom